Free and Special Economic Zones in Iran

Free and Special Economic Zones

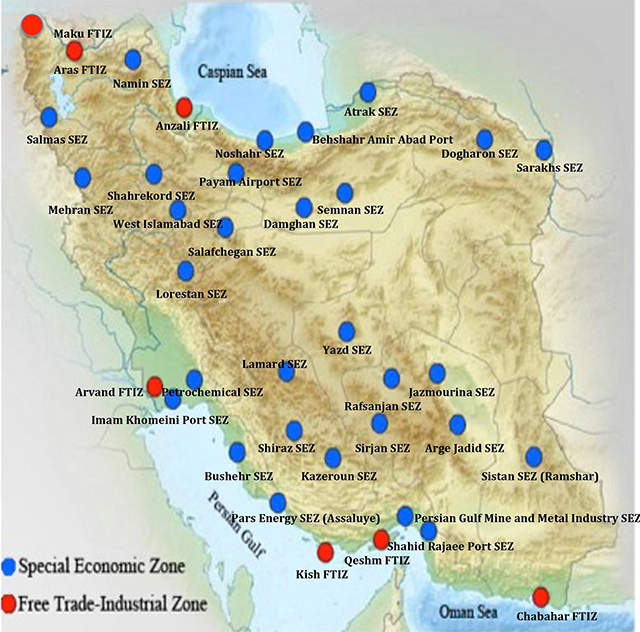

The Iranian Government operates six free trade zones and 16 special economic zones in the country, with the most prominent being Kish Free Trade Zone, Qeshm Free Trade Zone and Chabahar Free Trade Industrial Zone. These zones have been specifically set up to support economic activities and facilitate international trade relations and offer attractive guarantees and protections to foreign investors.

Companies and investors in these zones are exempt from routine taxation and other customary charges that are imposed on mainland Iran.

List of Free Trade Zones

- Qeshm Trade Industrial Free Zone

- Chabahar Trade Industrial Free Zone

- Aras Trade Industrial Free Zone

- Anzali Trade Industrial Free Zone

- Arvand Trade Industrial Free Zone

- Kish Trade Industrial Free Zone

- Maku Trade-Industrial Free Zone

Benefits of Free Trade Zones

- 20-year tax exemption

- No visa requirements for the entrance of foreigners

- Customs exemption

- Easy Registration of companies

- Easy circumstances for re-export and transit of commodities

- Possibility of exporting products to the mainland

- Long term lease of land for foreigners

- Foreign investments up to any ratio (of capital investment).

- Offshore banking and non banking credit practices.

- 100% repatriation of capital and profit at any time.

- Less bureaucratic than operating in the mainland

- No currency restrictions

- Special employment and labour regulations

Special Economic Zones

Special economic zones were created to improve the supply and distribution networks in the country and act as conduits and channels for goods in transit.

Their benefits include:

- Reducing customs procedures for import of goods from abroad or free trade zones

- No customs procedures for export of goods

- Each free zone is administered by its own authority and is organised as a company, with an autonomous legal status. Issuance of permits for all economic activities within the free zone, rests solely with the respective authority.

- Renting land to foreign nationals is permitted, however the sale of land to foreigners or to companies whose capital is wholly or partially owned by foreigners is prohibited.

- Foreign investors may participate in the economic activities of the free zone in any investment ratio they wish to. The legal rights of investors are guaranteed and protected. Foreign investors also have the option to safeguard their capital and rights by operating under the provisions of FIPPA (Iran's Investment, Promotion and Protection Act)

- In principle expatriation of profits and movement of capital generated by economic activities and commercial operations in the free zone is free and permitted, without hindrance.

- The exchange of goods between each zone and outside the country is excluded from the Import/Export regulations. However, exchange of goods between each zone and the rest of the country, is governed by the national regulations on the export and import of goods.

Visa Information

Getting a visa for these trade zones is far easier for a British citizen than accessing the mainland Iran. You can get a visa at the point of entry (no need to apply beforehand) for two weeks, and these may be extended for up to six months.

It is important to note that British Passport holders can have a visa at the port of entry only if they are able to fly in directly to a free zone e.g. Kish Island.